The Hidden Dangers of Skipping a Home Inspection

What happens if the buyer decides to forego a home inspection? Skipping this crucial step can lead to unexpected surprises and serious risks down the line. Choosing to bypass a home inspection might seem like a way to speed up the buying process or make an offer more appealing in a hot real estate market, but it can potentially open the door to a host of issues. Here’s a quick look at the potential consequences:

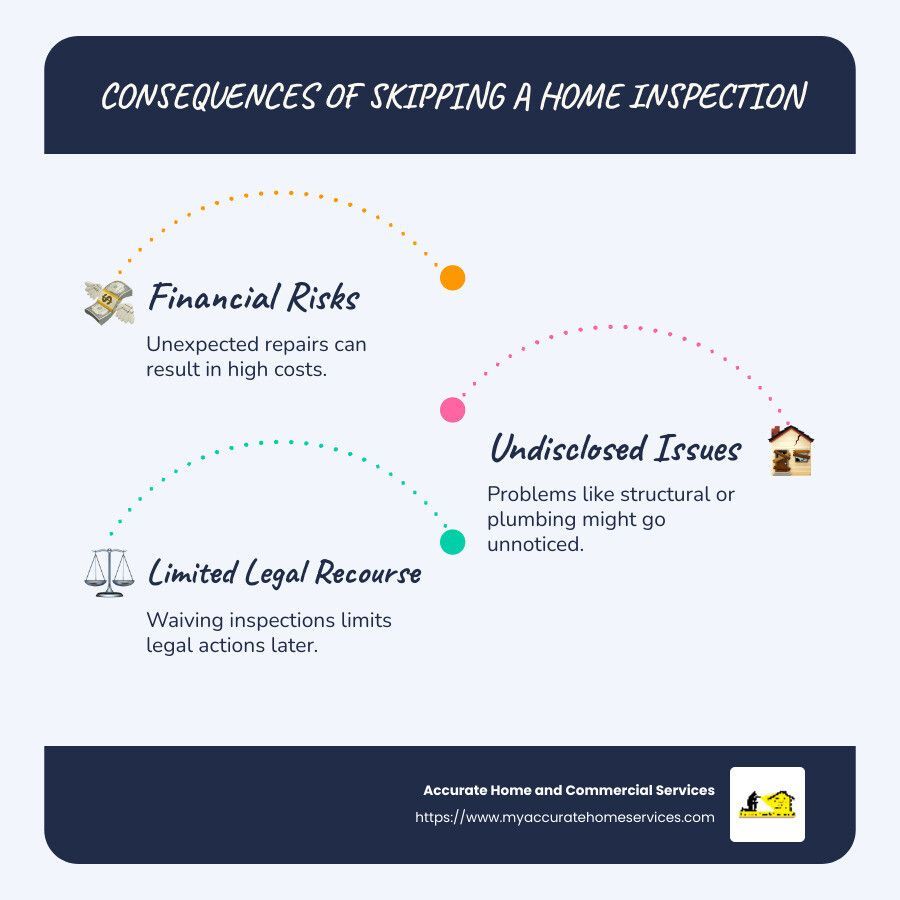

- Financial Risks: Unforeseen repairs can cost thousands.

- Undisclosed Issues: Structural, electrical, or plumbing problems might not be found.

- Limited Legal Recourse: Waiving inspections often reduces your ability to claim legal action later.

Navigating the real estate market in places like Greater Houston brings unique challenges. Buyers face intense competition, leading some to waive this critical step. However, home inspections are essential to safeguard the buyer's financial investment and uncover hidden dangers.

According to home expert Adam Long, "The number of individuals purchasing a home and waiving the inspection is higher than in the past." This surge is driven by the fear of missing out on a desired property, but buyers might miss essential insights into the home's vulnerabilities. Understanding these risks can empower homeowners to make informed, confident decisions about their property investments.

What Happens if the Buyer Decides to Forego a Home Inspection?

Choosing to waive a home inspection can seem tempting, especially in a competitive market like Greater Houston. Yet, this decision carries significant risks for buyers and offers certain advantages to sellers.

Buyer Risks

- Financial Pitfalls: Skipping a home inspection can lead to costly surprises. Repairs for issues like foundation cracks, faulty wiring, or plumbing leaks can quickly add up to thousands of dollars. Imagine moving into your new home only to find the HVAC system needs replacement—a repair that could cost upwards of $7,000.

- Undisclosed Problems: Without an inspection, buyers may remain unaware of hidden issues. Structural damage, mold, or pest infestations can lurk beneath the surface, waiting to become your problem. A professional home inspection is one of the few ways to uncover these potential dangers before committing to a purchase.

- Limited Legal Options: Waiving the inspection often means buying the home "as is." This limits your legal recourse if undisclosed issues arise later. While you might have grounds to sue if the seller intentionally hid problems, proving this can be challenging and costly.

Seller Advantage

For sellers, a waived inspection can be a boon. It reduces the likelihood of the buyer requesting repairs or price reductions based on inspection findings. This can streamline the selling process and potentially lead to a quicker sale. In a hot market, sellers may even favor offers that skip inspections, as these deals tend to close faster and with fewer complications.

However, buyers should weigh these seller advantages against their own risks. A home inspection is a key safeguard that can prevent buyer's remorse and protect your investment.

Risks of Waiving a Home Inspection

Waiving a home inspection might seem like a shortcut to securing your dream home, but it can lead to serious consequences. Let's explore the potential risks you face when you skip this critical step.

Financial Risks

Foregoing a home inspection can result in unexpected financial burdens. Hidden defects like roof leaks or structural issues can cost tens of thousands of dollars to fix. For example, fixing foundation problems can run from $5,000 to $15,000 or more, depending on the severity. These are expenses you might not be prepared for, turning your dream home into a financial nightmare.

Undisclosed Issues

Without a professional inspection, you might miss serious problems that aren't immediately visible. Mold, termite infestations, or faulty electrical systems can remain hidden until they cause significant damage. These issues not only affect the property's value but can also pose health and safety risks. A home inspection is one of the few ways to uncover these problems before they become your responsibility.

Legal Rights

Waiving a home inspection often means accepting the property "as is," limiting your legal rights if issues arise. You could find yourself stuck with costly repairs and little recourse. While you might have legal grounds if the seller intentionally hid problems, proving this can be difficult. Legal battles are expensive and time-consuming, adding stress to your home-buying experience.

Key Takeaway: Skipping a home inspection might save time initially, but it can lead to significant financial and legal challenges. Protect your investment by prioritizing a thorough inspection before committing to a purchase.

Why Buyers Waive Home Inspections

In a sizzling real estate market, what happens if the buyer decides to forego a home inspection? Let's explore why some buyers skip this crucial step.

Competitive Market

In today's housing market, buyers often face intense competition. Sellers have multiple offers to choose from, and a buyer might feel pressure to make their offer stand out. Waiving the inspection can make an offer more attractive because it reduces the risk of delays or cancellations. According to the REALTORS® Confidence Index, 27% of buyers waived the inspection contingency as of July, hoping to win bidding wars.

Faster Process

Skipping the inspection can speed up the buying process. Without waiting for an inspection, buyers can close the deal more quickly. This might appeal to sellers who want to move fast, especially if they're juggling multiple offers. A quicker closing can be a decisive factor in winning a competitive bid.

Cost Concerns

Some buyers might skip the inspection to save money upfront. Inspections typically cost between $300 and $500, depending on the property's size and location. For some, this might seem like an unnecessary expense, especially if they're stretching their budget to afford the purchase price. However, this small savings can lead to much larger costs down the road if hidden issues are finded after the sale.

Key Insight: While waiving a home inspection might help you secure a property in a hot market, it comes with significant risks. Consider the long-term implications before deciding to skip this important step.

How to Mitigate Risks When Skipping an Inspection

Even if you're considering skipping a home inspection, you can still take steps to reduce potential risks. Here are some strategies to protect your investment:

Pre-Offer Inspection

A pre-offer inspection is a smart move. This involves conducting a quick inspection before making an offer. It can give you a snapshot of the property's condition, helping you make an informed decision. While it might not be as detailed as a full inspection, it can highlight major issues and help you decide if waiving the inspection is worth the risk.

Seller Reports

Ask for seller disclosure reports. These documents, required in many states, list known issues with the property. They can include information about past repairs, water damage, or other significant problems. While these reports aren't a substitute for an inspection, they provide valuable insights into potential issues that could affect your decision.

Legal Advice

Consulting with a real estate attorney is wise. They can review the purchase agreement and advise you on your rights and risks. If you waive the inspection, you might lose some legal recourse if issues arise later. A lawyer can help you understand these implications and suggest protective measures, such as specific contract clauses.

By taking these steps, you can mitigate some risks associated with skipping a home inspection. However, these measures are not foolproof. Always weigh the potential savings against the risks of unforeseen repairs or legal challenges.

Frequently Asked Questions about Skipping Home Inspections

Do you lose earnest money if an inspection fails?

When a buyer puts down earnest money, it serves as a symbol of commitment in the home-buying journey. This deposit is usually kept in escrow until the deal is closed. If your contract includes an inspection contingency, you have a safety net. Should the inspection reveal major issues, this contingency allows you to withdraw from the purchase without forfeiting your earnest money. It's a protective measure for buyers, ensuring they can retreat from a deal if critical problems are uncovered during the inspection.

However, if you waive the inspection contingency and later find issues, you may have to forfeit your earnest money if you back out of the deal. Always consider the implications of skipping contingencies, especially when earnest money is involved.

Why would a buyer waive a home inspection?

Buyers might choose to waive a home inspection for several reasons. In a competitive market, where multiple offers are common, waiving the inspection can make your offer more attractive to sellers. Some buyers believe this strategy helps them stand out and secure the property.

Another reason is the desire for a faster process. Skipping the inspection can speed up the transaction, which might appeal to both the buyer and seller if time is of the essence. Additionally, some buyers are concerned about the cost of inspections, even though they typically range from $300 to $500—a small price compared to the potential cost of unfinded issues.

What is the biggest red flag in a home inspection?

A home inspection can reveal many issues, but hidden damage and structural issues are among the most concerning. These problems can lead to costly and extensive repairs. For instance, foundation cracks can indicate serious instability, while hidden water damage might suggest mold or rot. Both can significantly affect the home's safety and value.

When considering waiving an inspection, these red flags could go unnoticed without a professional evaluation. Even in a competitive market, it's crucial to weigh the potential risks of skipping an inspection against the short-term benefits.

Conclusion

Making Informed Decisions for Property Safety

When buying a home, making informed decisions is essential to ensure the safety and value of your investment. Skipping a home inspection might seem like a quick route to securing a property, especially in a competitive market. However, the risks involved can lead to significant financial and safety issues down the line.

Accurate Home and Commercial Services in Conroe, TX, offers comprehensive home inspection services that can help you avoid these pitfalls. With our extensive experience and attention to detail, we provide thorough inspections that uncover potential problems before they become costly surprises. Our services cover everything from structural issues to pest control, ensuring that your new home is safe and sound.

Choosing to work with professionals like us gives you the peace of mind that comes from knowing your property has been thoroughly evaluated. This not only safeguards your financial investment but also ensures the long-term safety of your new home.

For more information on how we can assist you, visit our Home Inspections page. Making the right decisions today can protect your future.